Recruit at RIT

Recruit at RIT

Breadcrumb

- RIT/

- Career Services and Co-op/

- Employers/

- Recruit at RIT

Career Connect

Contact

Office of Career Services and Cooperative Education

CareerServices@rit.edu

585-475-2301

Prepare for your recruiting season with Career Services

Career Services offers a range of tailored services to ensure employers of any size can effectively connect with RIT students and alumni. Opportunities include:

- Job Postings: Share your co-op/internship or full-time job opportunities on our preferred platform Career Connect, powered by Symplicity.

- Recruiting Events: Host virtual or in-person information sessions, networking one-on-one sessions, or recruitment tables to promote your organization to our students.

- Resume Collection and Interviews: Collect resumes and conduct interviews with students and alumni through on-campus or virtual interviewing.

- Career Fairs and Networking Events: Participate in our career fairs and networking events to connect with a diverse pool of talent.

- Mock Interviews and Workshops: Volunteer to conduct mock interviews or participate in career workshops to share your expertise with students.

- Resume Books: Access a diverse range of resume books through Career Connect. Search using various criteria and easily email or download resumes of selected students and alumni.

- Engage with Affinity Groups and International Students: Expand your recruitment reach by connecting with RIT affinity groups and international students, enriching your talent pool.

- And More...

Each employer partner is paired with a specific Career Services contact for recruitment needs. To learn more about recruiting and participating in career fairs, please contact us at careerservices@rit.edu or 585-475-2301.

Academic Schedule

Spring Semester

Jan. 16–May 8, 2024

Summer Term

May 15–Aug. 13, 2024

Fall Semester

Aug. 26–Dec. 18, 2024

Semester Break

Dec. 19, 2024–Jan. 12, 2025

Dates reflect first day of classes and last day of exams. Students may have the flexibility to begin work earlier or continue their co-op beyond the start and end dates during the RIT semester breaks. View RIT's academic calendar

RIT Career Connect

What are some advantages of our preferred career platform RIT Career Connect, powered by Symplicity?

- Easily reach more than 19,000 undergraduate and graduate students and alumni.

- Tap into the talent you seek. RIT students and alumni come prepared having been immersed in the latest technology and education in their field.

An account may have already been created for you. To check if an account exists, select "Forgot Password" and enter a username (email address) to receive a reset password link.

If your employer does not have an account, select "Sign Up" to create a profile.

Update your personal information by accessing your profile in the upper right-hand corner. You can update the employer profile on the left-hand side. Note that changes to the employer profile will apply to all associated contacts.

RIT Career Connect is a quick and easy way to manage your recruitment activities. After logging in, you will find a left-hand navigation bar that includes:

- Employer Profile: The employer profile is viewable to students and provides them with information about the employer. It is important to update the employer profile so it reflects the current state of your organization.

- Jobs: Post new jobs and review current and archived postings and applicants.

- OCR: Manage OCR (on-campus and virtual recruitment) activities, including requesting schedules, reviewing applicants, and managing interview schedules.

- Events: Register for upcoming career fairs, request information sessions and resume books.

- My Account: Update your account password, email preferences, and contact information as needed.

There are also “quick action” links along the right-hand side menu to direct you to specific, frequently used areas of the system.

Post Jobs

Follow these simple steps to post a job position in RIT Career Connect:

- Select "Jobs" in the left navigation.

- Choose "Job Postings."

- On the new job menu page, select "Post a Job."

- You can either copy a previous posting or complete the form for a new position.

- After submission, Career Services will review the job posting for approval.

- Track the status in the "Job Postings" menu.

Schedule Interviews

In RIT Career Connect, the OCR (on-campus and virtual recruitment) tab allows you to request interview schedules, review positions and applicants, and access interviews. Access the OCR tab on the left navigation or the quick access link on the right-hand side.

For on-campus interviews, utilize our updated facilities in Bausch & Lomb Center, featuring seven designated interview rooms.

Host Information Sessions

Information sessions are an excellent opportunity for employers to promote their career opportunities, employee benefits, work culture, and recruit new talent. Information sessions can be held on-campus, virtually, or through various formats like recruitment tabling or one-on-one networking events.

To request recruitment events in RIT Career Connect:

- Navigate to the "Events" tab on the left-hand side.

- Select the type of event you wish to host: on-campus or virtual information session, networking one-on-one, or recruitment tabling.

- Click "Request Information Session" and complete the event details for Career Services to review and approve.

For more details or assistance, please reach out to your Career Services contact or email us at careerservices@rit.edu.

Event Best Practices

- Timing is everything: Consider holding your information session early in the semester to get a jump on the competitive recruitment season.

- Post Your Positions: Post your job positions and let students know what skill sets or majors you are seeking.

- Give Your Information Session a Title: Drive attendance by using a title that helps reflect the content of the event.

- Send the Right Presenters: Choose alumni, new hires, co-ops, or hiring managers with insights into specific job openings or work culture.

- Host a Recruitment Table on Campus: Set up a recruitment table in high-traffic areas on campus for broad student outreach.

- Consider Taking the Time for a Networking One-on-One Event: While presentations to large groups are efficient, holding 10-15 minute one-on-one conversations often generates more student interest.

- Make it Interactive: Students can be deterred by information sessions that seem like college lectures. Combat this by making your event interactive with trivia questions, polls, games, or round-robin events with a group of recruiters.

- Give Away Branded Materials: Boost brand recognition and attract students by offering branded freebies during your event.

- Partner with On-Campus Organizations: Connect with the talent you’re trying to attract by reaching out to on-campus RIT Student Clubs and Organizations.

Register for Career Fairs

Access career fair registration in RIT Career Connect:

- Select the desired career fair and you will be directed to the career fair's information page.

- Review event details, including the main contact for questions.

- Find the registration button in the top right corner.

Upon clicking, you'll be directed to a registration form that includes number of representatives, booths, and payment plans. Career Services will work with you to determine whether the event is a good fit or if other options better support your recruiting goals.

Career Fairs

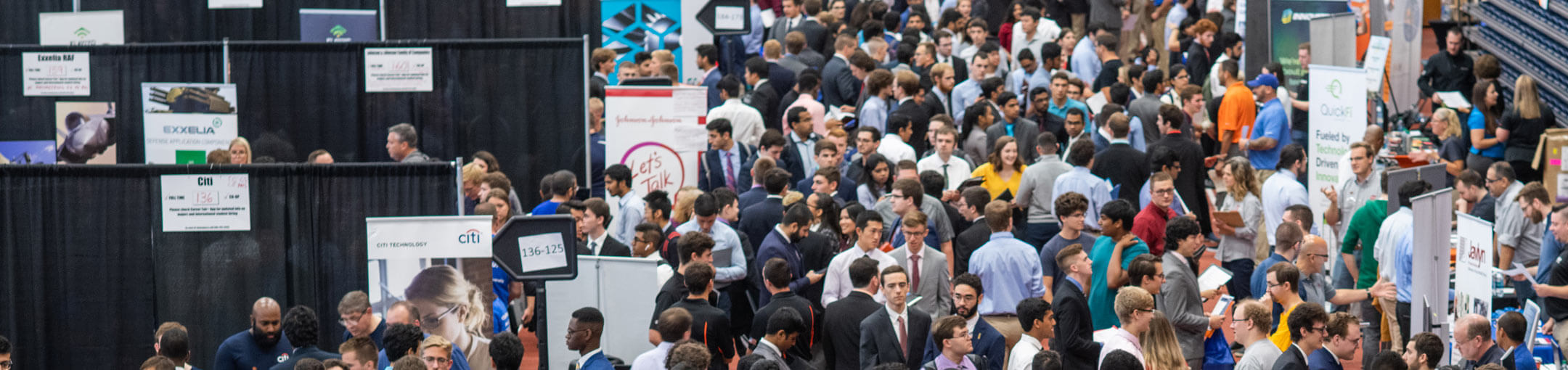

Career Services organizes the University-Wide Career Fair twice a year as well as four specialized fairs for RIT students to connect with employers for co-op, internship, research, and full-time opportunities.

Recruitment Expectations

We adhere to the National Association of Colleges and Employers (NACE) Job Offer Guidelines and Principles for Ethical Professional Practice.

All job postings are accepted with the understanding that the employing organization gives fair and open consideration to all applicants for employment regardless of race, color, national origin, sex, marital status, physical handicap, sexual orientation, or status as a disabled veteran of the wars including Vietnam. It is also agreed that students and graduates will be accepted and assigned to jobs and otherwise treated without regard to the factors identified above.

Employers advertising jobs in the states of New York, California, Colorado and Washington ARE REQUIRED to include a good faith salary range for every job, promotion, and transfer opportunity advertised per each States Legislation. For example in NYS Legislation S.9427-A/A.10477 establishes a pay transparency law in New York State, requiring employers to list salary ranges in advertisements or postings for job opportunities and promotions.

This act prohibits citizenship status and national origin discrimination with respect to hiring, termination, and recruiting or referring for a fee. 8 U.S.C §1324(a)(1)(B). Employers may not treat individuals differently because they are, or are not, U.S. citizens or work authorized individuals. U.S. citizens, asylees, refugees, recent permanent residents, and temporary residents are protected from citizenship status discrimination. Employers may not reject valid employment eligibility documents or require more or different documents on the basis of a person’s national origin or citizenship status.

Any postings which require U.S. citizenship only will be accepted if your organization is required by law, regulation, executive order, or government contract to do so.

This act prohibits citizenship status and national origin discrimination with respect to hiring, termination, and recruiting or referring for a fee. 8 U.S.C §1324(a)(1)(B). Employers may not treat individuals differently because they are, or are not, U.S. citizens or work authorized individuals. U.S. citizens, asylees, refugees, recent permanent residents, and temporary residents are protected from citizenship status discrimination. Employers may not reject valid employment eligibility documents or require more or different documents on the basis of a person’s national origin or citizenship status.

RIT’s Alcohol and Other Drug Policy (D18.1) and Faculty/Staff Alcohol and Drug Policy (C15.2) require that the university comply with local, state, and federal law. To the extent a proposed posting or internship involves the manufacture, distribution, dispensing, possession, or use of a substance defined as controlled by the federal government, RIT will decline all such postings and internship/co-op opportunities and will not allow recruitment of our students.