Employee Travel Reimbursement Manual

Creating a Travel Expense Report in IExpenses

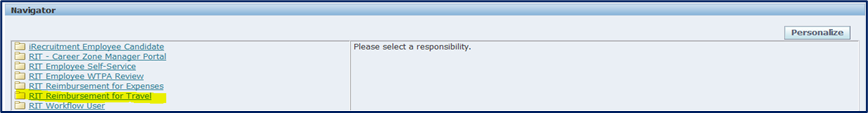

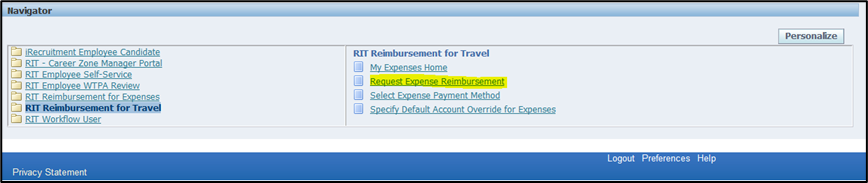

- When logged into Oracle, this is your list of available responsibilities

- Select RIT Reimbursement for Travel

- Select – Request Expense Reimbursement

Note: To speed-up the process of entering your expense report it is helpful to have your receipts readily available

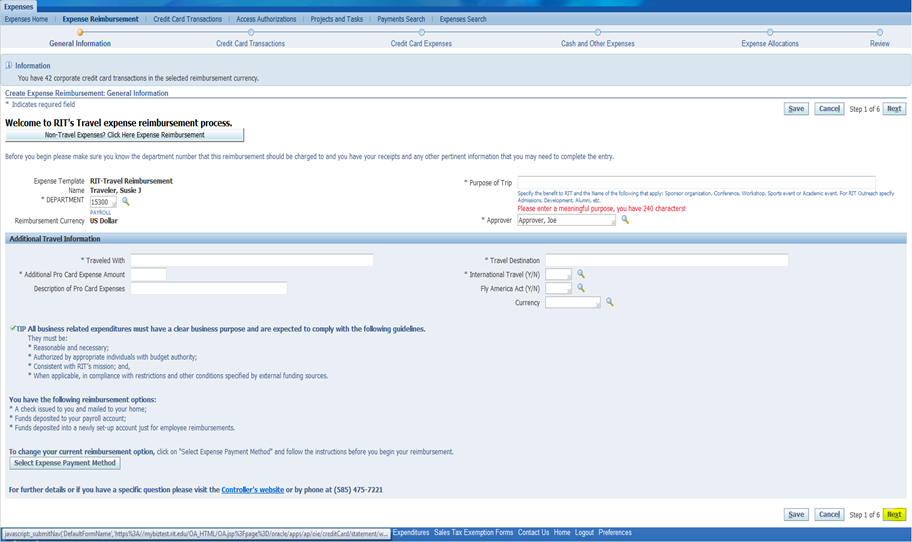

- Complete all required fields (* Indicates each required field)

- It is important to clearly state the business purpose of this trip. The field can accommodate up to 240 characters

- If you traveled alone – Indicate so in the ‘Traveled with’ field

- Enter any Pro Card Expenses associated with this trip – i.e. Registration Fees. If there are none enter zero dollars

- If you answered YES to International Travel you must also complete the Fly America Act filed and enter the currency used for the majority of this trip

- Click Next

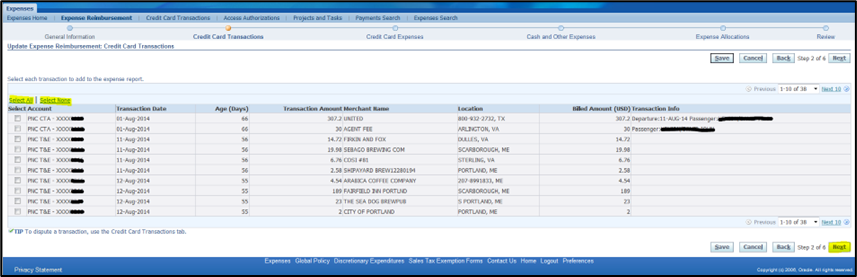

- This screen will only be visible to those travelers that have a PNC Travel card and have charges that can be applied to their travel reimbursement.

- If all of the credit card charges can be applied to the travel expense report you are working on then ‘Select All’ or you can click on only those that apply

- Click – Next

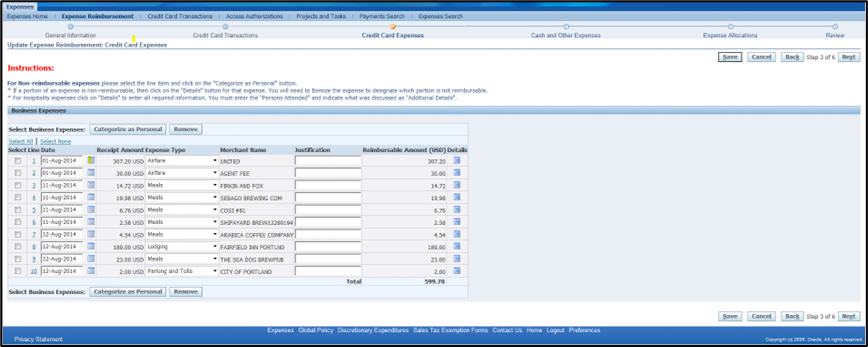

- Verify that the credit card transactions pertain to the travel expense report you are currently working on

- Since the dates are when the merchant charged the credit card - modify the dates as needed to match your receipts

- Since airline charges are usually in advance of the actual date of the trip – change the date to coincide with your departure date

- The Expense Type is based on the merchant MCC code – Please verify that the expense type is correct. If the Expense type is not correct choose the appropriate type from the pull down menu

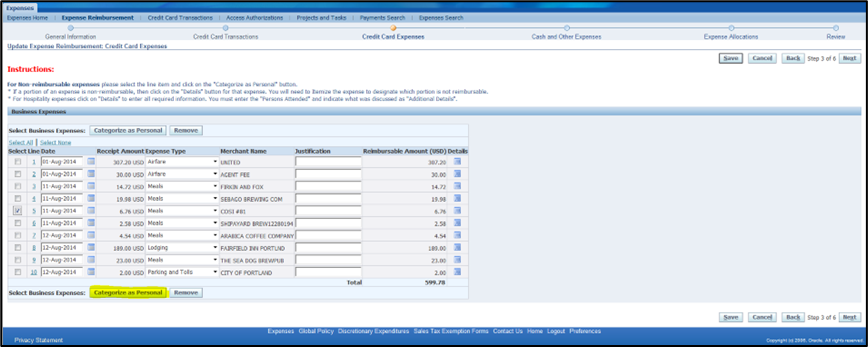

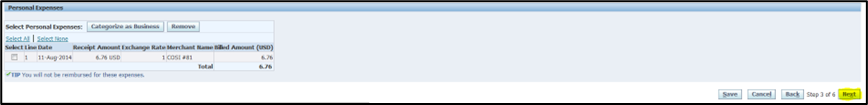

Categorizing an Expense as Personal

- Select the Expense

- Select - Categorize as Personal

- If you chose ‘Personal’ the transaction is not available for future use

- If you chose ‘Remove’ the transactions are available for use at a future date

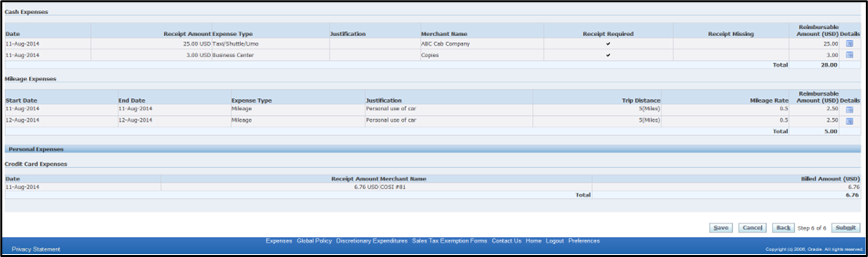

- The bottom of your page now displays the expense that is considered personal and not reimbursable

- Select –Next

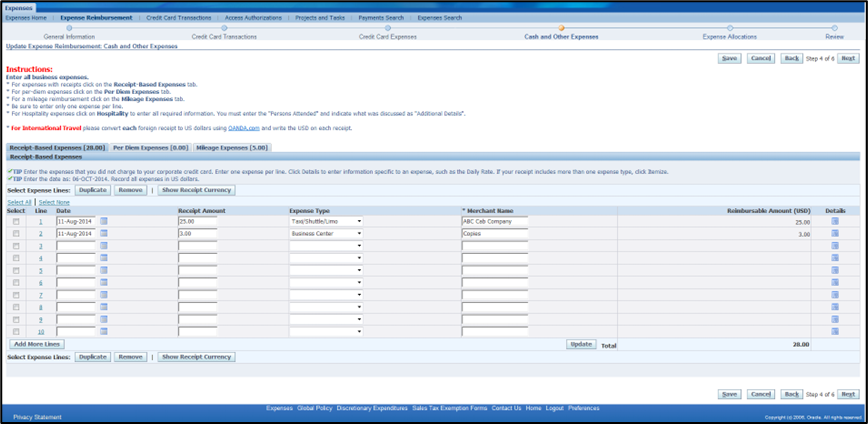

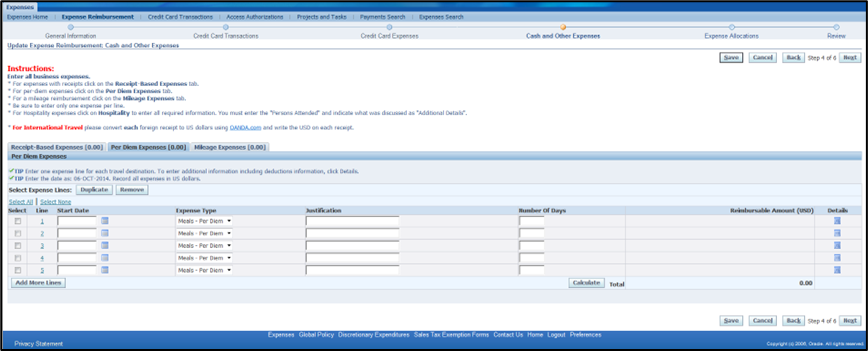

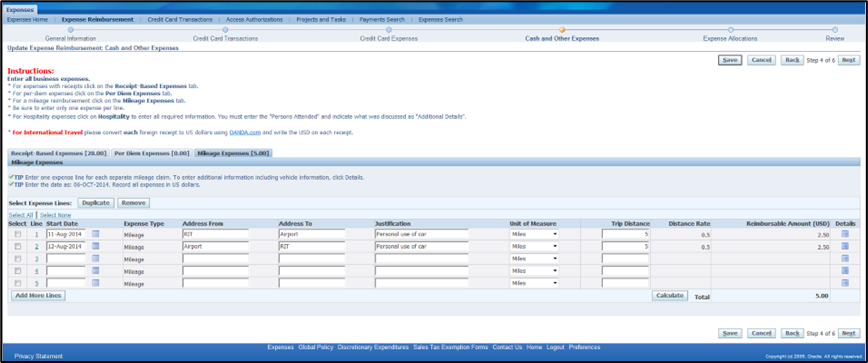

- There are 3 tabs to choose from:

- Receipt Based Expenses

- Per Diem Expenses

- Mileage Expenses

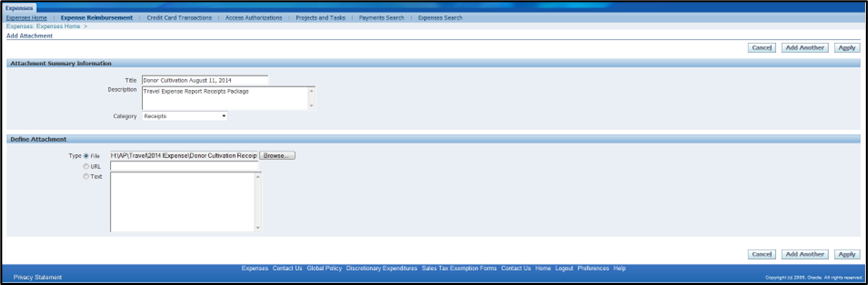

Attach Scanned Receipts

- Click - Add to attach your receipts

- Give your attachment a title – Anything that is meaningful to you

- Enter a description

- Click the browse button to locate your scanned copies

- Click – Open on your desktop to attach the documents

- Click Apply

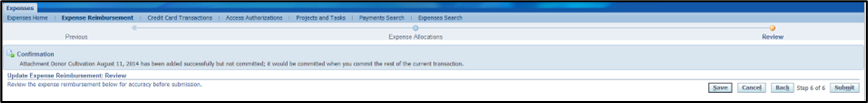

- A confirmation at the top of the page confirms that the document was successfully attached

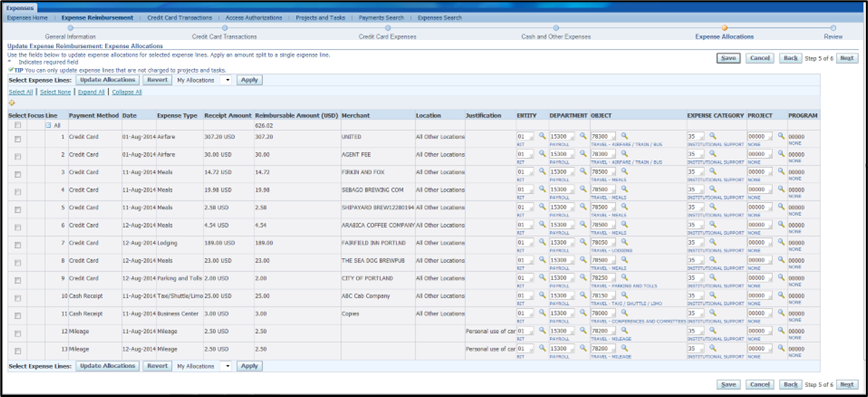

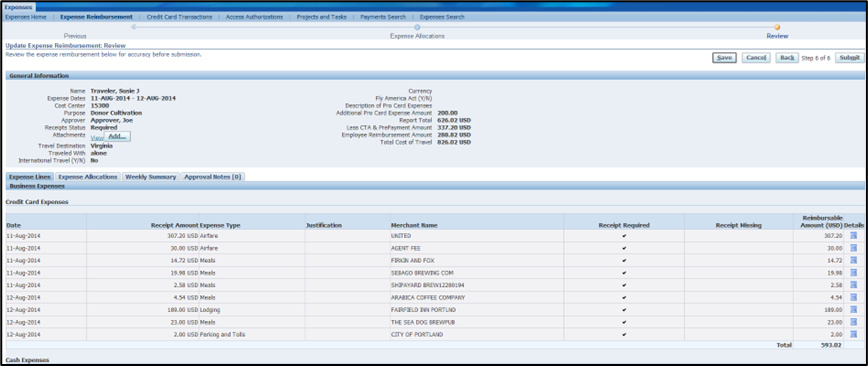

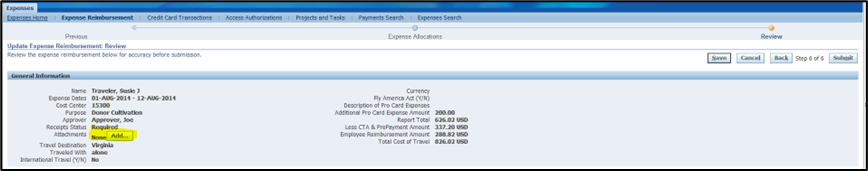

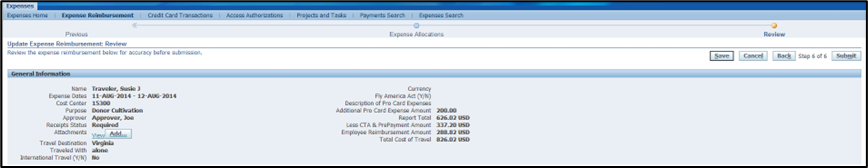

- The employees reimbursement summary, total cost of trip, pre-paid airfare and Pcard Expenses are located at the top of the summary page

- Click – submit