Job & Employment Scams

- RIT/

- Security/

- Resources/

- Types of Threats/

- Job & Employment Scams

Recognize, Respond, Report

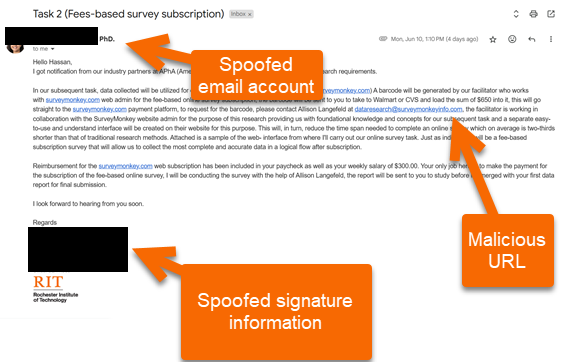

Job scams are fraudulent job offers or employment schemes where the attackers trick individuals into providing personal information, paying money, or performing work without proper compensation. These scams often promise high-paying roles with little to no experience required and utilize fake job postings, emails, or websites to lure in unsuspecting victims.

Recognize

- Be cautious of job offers that seem too good to be true.

- Be cautious of job offers that require you to pay a fee or request you to provide sensitive information. Legitimate job offers will never ask for money or sensitive information.

- Be suspicious of generic emails and job offers that do not address you by name.

- If a supposed recruiter asks for personal information or payment before you have a chance to interview or verify their legitimacy this is likely a scam.

Respond

- If you receive an unexpected job offer, research the company and recruiter before providing any personal information or scheduling an interview.

- If you receive an unexpected job offer and need help verifying its legitimacy, contact the Office of Career Services of the Information Security Office for assistance to ensure your personal information is protected.

Report

- If you receive a suspicious job offer, report it to the RIT service Center by phone at 585-475-5000, or online at help.rit.edu to open an incident report.

What if I am already involved in a scam?

- The student should immediately contact the local police. The police are responsible for conducting an investigation (regardless of whether the scam artist is local or in another state). At RIT, start by contacting Public Safety at 585-475-2853.

- If it is a situation where the student has sent money to a fraudulent employer, the student should contact their bank or credit card company immediately to close the account and dispute the charges.

- If the incident occurred completely over the internet, the student should file an incident report online at http://www.justice.gov/criminal-ccips, or by calling the FTC by phone at 1-877-FTC-HELP (1-877-382-4357).

See more at: https://www.symplicity.com/blog/2010/11/09/fraud-posting-tips/

For More Information

- IACLEA - Student's Guide to Fraud Scams (PDF)

- Federal Trade Commission - Consumer Information on Job Scams (external)

- Common Job Scams in 2022 (external)

- Additional Job Search Scams (external)

- Millennials and Job Scams (external)

- 8 Warning Signs of a Job Scam (external)

- Scams of the Heart (external)