2026 Medical Plans

- RIT/

- Human Resources/

- Employees/

- Benefits/

- 2026 Benefits Information for Regular Employees/

- 2026 Medical Plans

Medical Plan Options

RIT offers a variety of medical plan options to meet the needs of our employees. Whether you're looking for lower premiums, more options for care, or tax-advantaged savings, there's a plan for you.

Reminder: RIT covers most of the medical premium cost. Employee contributions vary based on the selected plan, coverage level, and salary tier. Rate information will be available soon.

2026 Medical Plan Options

- POS A

- POS B

- POS D

- High Deductible Health Plan

- Blue PPO (out-of-area employees only)

High Deductible Health Plan (HDHP)

As part of our ongoing commitment to your well-being, we are introducing a new medical plan this year: the High Deductible Health Plan (HDHP) with Health Savings Account (HSA). RIT is partnering with Fidelity to administer the HSA.

We know every employee’s health care needs are different, and we want to ensure you have options to support your personal health and lifestyle.

Is the HDHP right for you?

This plan may be a great option if you:

- Are generally healthy and don’t anticipate frequent (sick) medical visits

- Want lower monthly premiums

- Are comfortable paying more out-of-pocket when you need care

- Prefer to save and invest for future health care needs

- Need non-emergency coverage outside the Rochester area

The HDHP works differently than RIT’s other plans.

- Lower premiums, higher out-of-pocket costs: You pay less each paycheck but more out of pocket when you receive non-preventive care.

- Deductible first: You pay the full cost of your non-preventive medical care and prescriptions until you meet your deductible.

- After deductible: After meeting your deductible, you pay 20% coinsurance for medical services and copays for prescriptions until you reach your out-of-pocket maximum.

- After Your Out-Of-Pocket Maximum: Once you reach your out-of-pocket maximum, the plan pays 100% of eligible expenses for the rest of the year.

- Health Saving Account (HSA): The HDHP includes access to an HSA, which allows you to save tax-free dollars for qualified medical expenses, giving you more control and flexibility in how you manage your health care spending.

- Preventive care at no cost: Annual check ups and screenings are covered at 100% even before you meet your deductible.

- Prescription coverage: You pay the full cost of prescriptions until you meet your plan deductible.

- Specialists and hospitals: Access to the same in-network options as the POS plans.

- Emergency care: Covered after the deductible; your out-of-pocket maximum protects you from high costs.

- Telehealth options: See doctors virtually at a lower cost than in-office visits.

- Allowed amount maximum fees: The maximum amount an in-network provider has agreed to accept as payment for a covered service. You won’t be billed for charges above this amount.

- National in-network coverage: Ideal for employees and dependents living outside the Rochester area.

Benefit |

Details |

|---|---|

|

Deductible (Medical & Pharmacy Combined) |

|

|

Out-of-Pocket Maximum (Medical & Pharmacy Combined) |

|

|

Coinsurance (After Deductible, Before Out-of-Pocket Max) |

You pay 20%, plan pays 80% for:

|

|

Prescription Drug Copays (After Deductible, Before Out-of-Pocket Max) |

30-Day Supply (Wegmans Retail):

|

Summary provided by Excellus Blue Cross Blue Shield highlighting the key features, benefits, and coverage details of your medical plans. View the HDHP Medical Plan Summary, which has been updated to include RIT hearing benefits and other services.

The Summary of Benefits and Coverage (SBC) is a federally required document under the Affordable Care Act that clearly outlines health insurance plan’s benefits and costs. Provided by Excellus Blue Cross Blue Shield, the SBC uses a standardized format to present key information and coverage examples, helping you compare and understand your options.

Health Savings Account (HSA)

The HSA, administered by Fidelity, allows you to set aside tax-free funds* to spend on any eligible health care expenses you choose—now or in the future.

*HSA contributions and earnings are free of federal taxes, but are considered taxable income in some states. Under current law, HSA contributions are tax-free in New York State.

With the HDHP, you can use your HSA to:

- Save tax-free dollars for qualified medical expenses

- Pay for current or future health care costs

- Roll over unused funds year to year

- Invest your HSA savings for long-term growth

This option gives you more flexibility and control in managing your health care spending and saving.

- Enrollment is optional: Elect the HSA in Oracle during open enrollment if you want to participate.

- Employees will receive a welcome email from Fidelity in November, and reminder emails through December, with instructions for account setup. You’ll receive a debit card to access these funds.

- Fidelity charges a $20 annual account maintenance fee, billed in $5 quarterly installments and deducted from your HSA funds.

- Employees will receive a welcome email from Fidelity in November, and reminder emails through December, with instructions for account setup. You’ll receive a debit card to access these funds.

- Make pre-tax contributions from your paycheck to your HSA in any amount you choose, up to the IRS annual limits.

- RIT contributes to the HSA for all regular full-time employees:

- $300 for employees with individual coverage

- $600 for employees covering one or more dependents

- Contributions are credited in two installments: half in March, half in September.

- Part-time employees receive half of the full-time contribution.

- You can change your HSA payroll contribution at any time during the year, even after your initial open enrollment election.

- Please note: You cannot open an HSA directly with Fidelity. To ensure RIT payroll deductions are deposited correctly, you must elect the HSA through Oracle.

| Coverage Level | 2026 IRS Limits | RIT's Initial Seed Contribution in 2026 |

Your Maximum Payroll Election |

| Individual | $4,400 | $300 | $4,100 |

| Family | $8,750 | $600 | $8,150 |

Note: If you are age 55 or older, you’re eligible to contribute an additional $1,000 per year.

You must meet specific eligibility requirements to contribute to an HSA. Before enrolling, please review the requirements below to ensure you are eligible:

- Must be enrolled in an HDHP. The IRS requires you to be enrolled in a qualified HDHP to contribute to an HSA. You cannot contribute if you are enrolled in a POS plan.

- No Health Care FSA. If you contribute to an HSA, you cannot contribute to a Health Care Flexible Spending Account (FSA), including through your spouse’s employer. You may, however, contribute to both an HSA and a Dependent Care FSA at the same time.

- Not eligible with certain coverage. If you are enrolled in any part of Medicare, TRICARE or Social Security Disability Insurance (SSDI), you are not able to participate in an HSA.

- Important: If you or your spouse are enrolled in a health care flexible spending account (FSA) for 2025 and enroll in the HDHP for 2026, you must spend down your FSA balance to $0 by Dec. 31, 2025, to be eligible to contribute to the HSA or receive RIT’s employer contribution.

Please note that a domestic partner who is not a tax dependent is not eligible for you to use your HSA funds on. However, an enrolled domestic partner can have their own FSA to cover their expenses while you maintain an HSA.

Ownership and Portability

- Your HSA funds are yours to keep, even if you change medical plans, leave RIT or retire.

- Unlike an FSA, your unspent HSA funds roll over each year, there is no “use it or lose it” rule.

Tax Benefits

- When you contribute: Your HSA contributions are made before taxes, which means you’ll pay less in taxes on your overall income.

- As your account grows: You earn tax-free interest on your money over time. The interest you earn even earns interest!

- When you spend: When you use your HSA funds for qualified health care expenses, you don’t pay taxes on those withdrawals.

Using and Investing your HSA

- You decide whether to pay for eligible health care expenses with HSA funds or out-of- pocket.

- Saving your HSA dollars now can help you pay for significant or unexpected health care expenses in the future.

- You can invest some or all of your balance in a variety of funds through Fidelity. This gives your savings the potential to grow over time, like a retirement plan for health care expenses.

- You can pay yourself back for eligible expenses only if your HSA was open when you incurred the cost. To take full advantage, it’s best to open your account as early as possible, ideally by January 1.

Both a Health Savings Account (HSA) and a Health Care Flexible Spending Account (FSA) let you set aside pre-tax dollars to pay for medical, dental, and vision expenses. But there are important differences between the two accounts.

Feature |

HSA |

Health Care FSA |

|---|---|---|

| Who owns the account? | You | RIT |

| Who can contribute? | You and RIT | You only |

| Can you invest the money? | Yes | No |

| Can you keep the balance if you leave RIT? | Yes | No |

| What are the tax benefits? | Pre-tax contributions, tax-free growth, tax-free withdrawals (all in most states) | Pre-tax contributions and tax-free withdrawals |

| Can funds roll over year to year? | Yes, even into retirement. | No, unused funds are forfeited at the end of the plan year. |

POS A

POS A is administered through Exellus Blue Cross Blue Shield and is RIT’s premium health care plan. It may be a good fit for those who do not mind paying the highest monthly premium so they can have predictable copays and the lowest out-of-pocket costs when receiving (non-preventive) care.

Is POS A Right For You?

This plan may be a great option if you:

- Need regular care for a chronic condition or frequent doctor visits.

- Prefer paying a higher premium per paycheck to have predictable, lower copays.

- Take multiple or expensive prescriptions.

- Copay Plan: With POS A, you pay a predictable copay each time you receive care

- Higher premium: You’ll pay more from your paycheck, but pay less when you need care.

- There’s no deductible for in-network services or deductible/coinsurance for certain services (inpatient hospitalization, outpatient surgery, advanced imaging) as in the other POS plans, so you don’t have to meet a higher upfront cost before coverage starts.

- Preventive care at no cost: Annual check ups and routine screenings are covered at 100% ($0 copay).

- In-network providers offer the best value. As long as you use in-network providers, your costs remain low and consistent.

- Out-of-network care is covered, but at a higher cost and may require claim submissions.

- Predictable copays for services like:

- Non-preventive services

- Specialist visits

- Hospitalization

- Imaging

Benefit |

Details |

|---|---|

|

Out-of-Pocket Maximum |

|

|

Primary & Specialty Care |

|

|

Urgent & Emergency Care |

|

|

Prescription Drug Coverage |

30-Day Supply (Wegmans Retail):

|

| Deductible and Coinsurance |

Not applicable |

Summary provided by Excellus Blue Cross Blue Shield highlighting the key features, benefits, and coverage details of your medical plans. View the POS A Medical Plan Summary, which has been updated to include RIT hearing benefits and other services.

The Summary of Benefits and Coverage (SBC) is a federally required document under the Affordable Care Act that clearly outlines health insurance plan’s benefits and costs. Provided by Excellus Blue Cross Blue Shield, the SBC uses a standardized format to present key information and coverage examples, helping you compare and understand your options.

POS B

POS B, administered through Excellus Blue Cross Blue Shield, provides comprehensive coverage with consistent, fixed copays for most services. A deductible and coinsurance applies only to inpatient hospitalization, outpatient surgery, and advanced imaging such as MRIs and CT scans.

Is POS B Right for You?

This plan may be a great option if you:

- Use health care regularly for ongoing medical needs.

- Prefer predictable costs, with fixed copays for most services except for certain lesser used services.

- Are comfortable with a limited deductible and coinsurance that only apply to inpatient hospitalization, outpatient surgery, and advanced imaging (such as MRIs and CT scans).

- Are okay paying a bit more for a plan that includes prescription drug copays without a deductible.

- Want a balance between cost and coverage: POS B offers comprehensive coverage at a lower premium than POS A.

- Copay Plan + Limited Deductible: You pay a predictable, fixed copay each time you receive non-preventire care, except for certain services.

- Limited Deductible: This plan includes a limited deductible that only applies to inpatient hospitalization, outpatient surgery, and advanced imaging tests such as MRIs and CT scans.

- Coinsurance: After meeting the deductible for any of those services, you pay 20% coinsurance and the plan pays the remaining 80%.

- Preventive care at no cost: Annual check ups and routine screenings are covered at 100% ($0 copay.)

- In-network providers offer the best value. As long as you use in-network providers, your costs remain low and consistent.

- Out-of-network care is covered, but at a higher cost and may require claim submissions.

- Predictable copays for services like:

- Non-preventive services

- Specialist visits

- Prescriptions

Benefit |

Details |

|---|---|

|

Out-of-Pocket Maximum |

|

|

Primary & Specialty Care |

|

|

Urgent & Emergency Care |

|

|

Deductible (applies to select services) |

|

| Coinsurance (applies to select services) |

After paying deductible (above), you pay 20%, plan pays 80% for:

|

| Prescription Drug Coverage |

30-Day Supply (Wegmans Retail):

|

Summary provided by Excellus Blue Cross Blue Shield highlighting the key features, benefits, and coverage details of your medical plans. View the POS B Medical Plan Summary, which has been updated to include RIT hearing benefits and other services.

The Summary of Benefits and Coverage (SBC) is a federally required document under the Affordable Care Act that clearly outlines health insurance plan’s benefits and costs. Provided by Excellus Blue Cross Blue Shield, the SBC uses a standardized format to present key information and coverage examples, helping you compare and understand your options.

POS D

POS D, administered through Excellus Blue Cross Blue Shield, offers fixed copays for most services. For prescription drugs, members pay the full cost up to a deductible, then set copays apply, providing predictable out-of-pocket costs once the deductible is met.

Is POS D Right for You?

This plan may be a great option if you:

- Typically only need routine or preventive care: Use healthcare services occasionally and don’t expect frequent doctor visits.

- Prefer lower premiums and are comfortable with higher copays when you use non-preventive services: POS D offers the lowest premiums among RIT’s health plans, but comes with higher copays compared to other plans.

- Prescription deductible: Are comfortable paying full cost upfront for prescriptions until the prescription deductible is met.

Copay Plan + Deductible

- Copay: You pay a predictable, fixed copay each time you receive care.

- Deductible: This plan includes a limited deductible that only applies to prescription coverage.

- Preventive care at no cost: Annual check ups and routine screenings are covered at 100% ($0 copay).

- In-network providers offer the best value. As long as you use in-network providers, your costs remain low and consistent.

- Out-of-network care is covered, but at a higher cost and may require claim submissions.

- Predictable copays for services like:

- Primary visits

- Specialist visits

- Urgent care

- Lab tests and routine x-rays

- Prescription drugs:

- Full cost until the Rx deductible is met

- Then fixed copays apply

|

Benefit |

Details |

|

Out-of-Pocket Maximum |

|

|

Annual Deductible |

|

|

Coinsurance |

You pay 20%, plan pays 80% for:

|

|

Primary & Specialty Care |

|

|

Urgent & Emergency Care |

|

|

Prescription Drug Coverage Deductible |

|

|

Prescription Drug Coverage |

30-Day Supply (Wegmans Retail):

|

Summary provided by Excellus Blue Cross Blue Shield highlighting the key features, benefits, and coverage details of your medical plans. View the POS D Medical Plan Summary, which has been updated to include RIT hearing benefits and other services.

The Summary of Benefits and Coverage (SBC) is a federally required document under the Affordable Care Act that clearly outlines health insurance plan’s benefits and costs. Provided by Excellus Blue Cross Blue Shield, the SBC uses a standardized format to present key information and coverage examples, helping you compare and understand your options.

BluePPO

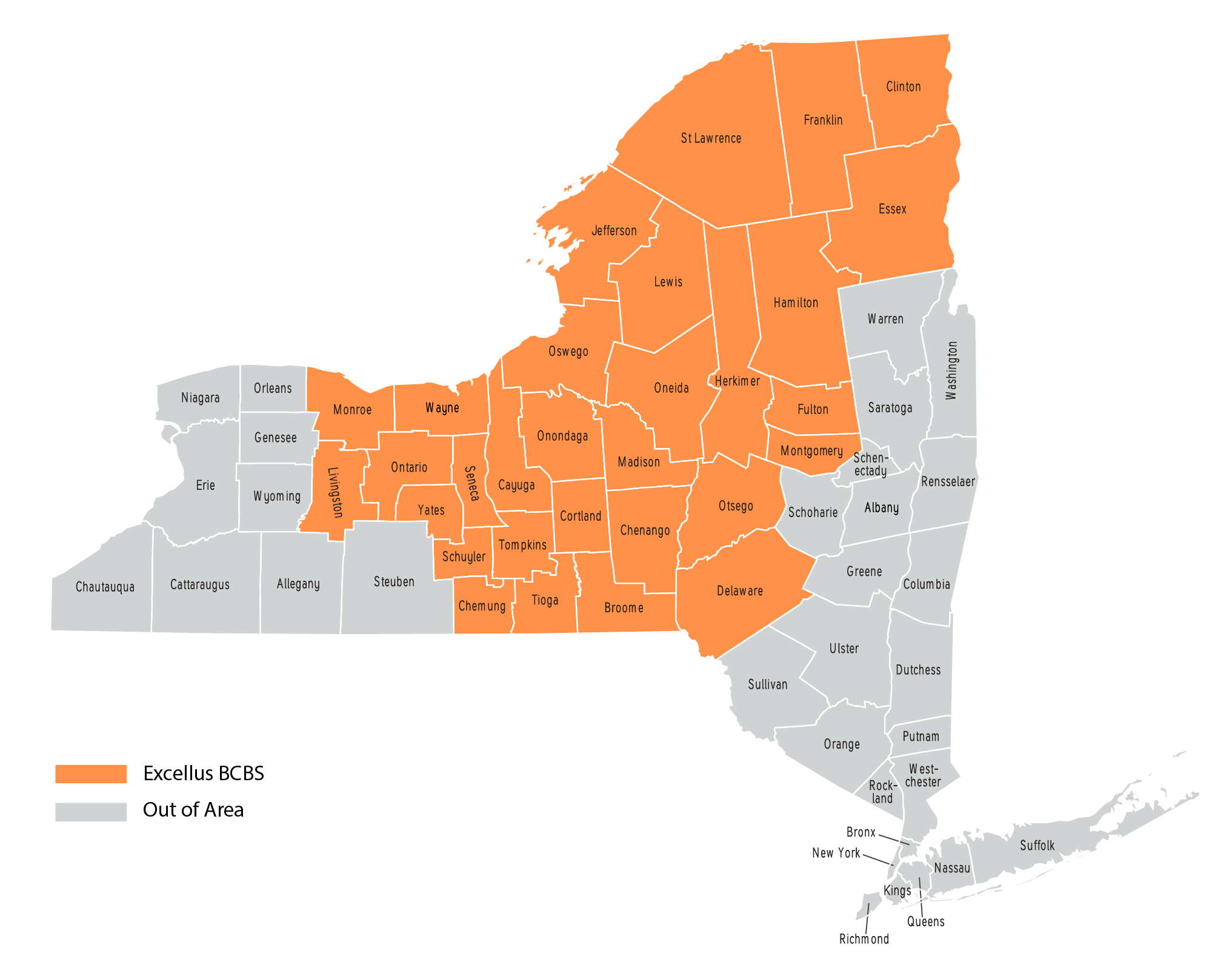

The BluePPO plan, administered by Excellus Blue Cross Blue Shield is available only to employees living and working outside the point-of-service (POS) area.

- Copay Plan + Limited Deductible: You pay a predictable, fixed copay each time you receive non-preventire care, except for certain services.

- Limited Deductible: This plan includes a limited deductible that only applies to inpatient hospitalization, outpatient surgery, and advanced imaging tests such as MRIs and CT scans.

- Coinsurance: After meeting the deductible for any of those services, you pay 20% coinsurance and the plan pays the remaining 80%.

- Preventive care at no cost: Annual check ups and routine screenings are covered at 100% ($0 copay).

- In-network providers offer the best value. As long as you use in-network providers, your costs remain low and consistent.

- Out-of-network care is covered, but at a higher cost and may require claim submissions.

- Predictable copays for services like:

- Primary visits

- Specialist visits

- Urgent care

|

Benefit |

Details |

|

Out-of-Pocket Maximum |

|

|

Annual Deductible |

|

|

Coinsurance |

You pay 20%, plan pays 80% for:

|

|

Primary & Specialty Care |

|

|

Urgent & Emergency Care |

|

|

Prescription Drug Coverage |

30-Day Supply (Wegmans Retail):

|

|

|

Summary provided by Excellus Blue Cross Blue Shield highlighting the key features, benefits, and coverage details of your medical plans. View the BluePPO Medical Plan Summary, which has been updated to include RIT hearing benefits and other services.

The Summary of Benefits and Coverage (SBC) is a federally required document under the Affordable Care Act that clearly outlines health insurance plan’s benefits and costs. Provided by Excellus Blue Cross Blue Shield, the SBC uses a standardized format to present key information and coverage examples, helping you compare and understand your options.

Pharmacy Benefit Manager

Optum Rx is RIT’s prescription drug coverage provider, offering access to participating pharmacies, cost-saving programs, and online resources to manage your prescriptions.

Optum Specialist Pharmacy

For specialty medications that require special handling or administration, Optum Specialist Pharmacy offers expert care and personalized support to ensure timely delivery and coordination of your treatment.

Wegmans Pharmacy Home Delivery

Enjoy the convenience of home delivery through Wegmans Pharmacy. This service delivers your maintenance medications right to your doorstep, saving you time and helping you stay on track with your treatment. Learn more

View the 2025 Prescription Drug Formulary.

Copay Assistance Programs for Specialty Prescriptions

As specialty prescription drug costs continue to rise, RIT is introducing two new copay assistance programs to help employees and their covered dependents reduce the cost to fill the specialty medications they need for complex or chronic conditions:

- PillarRx: For medications filled through OptumRx, such as those picked up at a pharmacy

- HelpScript: For medications processed through Excellus medical coverage, such as those administered in a doctor’s office or through infusions

These programs work alongside your pharmacy benefits to help reduce—or in some cases eliminate—the cost of certain specialty medications. Both programs are confidential and provide access to certified pharmacy technicians who can help fill specialty prescriptions, manage claims and coordinate between pharmacies, drug manufacturers and Excellus.

If you or a covered dependent takes a medication that qualifies for either program, PillarRx or HelpScript will contact you directly.

Make the Most of Your RIT Medical Plan

We understand it’s more important than ever to get the most value from your medical plan. Here are a few ways you can save money while staying healthy:

- Use in-network providers

Excellus BlueCross BlueShield providers will give you high-quality care at the most cost-effective rates.

- Get your preventive care

Annual check ups and routine screenings are covered at 100% under all RIT medical plans. These visits can give you peace of mind—or catch issues early, helping you avoid more serious health problems and higher costs later.

- Ask for generic medications

Generic medications are safe, effective and approved by the Food and Drug Administration. They typically cost much less than brand-name medications. If you are notified that your specialty medication qualifies for one of RIT’s two new copay assistance programs, be sure to use it to save significantly.

- Use Excellus BlueCross BlueShield’s online resources

Visit member.excellusbcbs.com for articles about a variety of health topics, discounts on health and fitness products and services, health coaching, healthy recipes and more.

- MD Live (Telemedicine): With telemedicine, you and your covered family members have access to care 24/7 for common, nonemergency issues from the comfort of your home, office or hotel room.

Medical Plan Resources

It’s important to evaluate your personal health needs alongside the coverage details and costs of each medical plan to determine which option best fits your situation.

- Premium: The amount you pay for health care coverage up front, deducted pre-tax from your paycheck.

- Deductible: The amount of medical expenses you’re responsible for before your plan begins to pay each year.

- Coinsurance: The portion you’re required to pay for services after you meet your deductible. It’s a percentage of the total cost; for example, if your coinsurance is 20%, you pay 20% of a medical bill while your plan pays 80%.

- Copay: The set amount you pay for a covered service at the time you receive it. This amount can vary by type of service.

- Out-of-pocket costs: The amount your medical plan does not cover and you’re therefore required to pay for a service. For example, a copay is an out-of-pocket cost.

- Out-of-pocket maximum: The maximum amount you will have to pay each year for medical costs. This amount includes your deductible, coinsurance, and copays, but does not include your monthly premium payments or costs for non-covered services. After reaching the out-of-pocket maximum, your plan pays 100%.

Plan |

Vendor |

Phone Number |

|

Medical Coverage |

Excellus BlueCross BlueShield |

800-724-1675/V and 585-454-2845/TTY |

|

Prescription Drug |

855-209-1300 |

|

|

Prescription Drug |

800-934-6267 (call transferred to local store) |

|

| Dental | Excellus BlueCross BlueShield | 800-724-1675/V and 585-454-2845/TTY |

| Vision | VSP | 800-877-7195/V and 800-428-4833/TTY |

| Health Savings Account | Fidelity Fidelity HSA Education Center |

800-544-3716 |

We understand that health care isn’t one-size-fits-all. That’s why Upwise offers a free medical plan cost calculator to help you make an informed decision.

Sign up with your RIT email, enter details about your personal circumstances, and Upwise will generate customized information to help guide your choice.

Upwise Medical Plan Cost Calculator

Need help? View the Upwise Medical Plan Cost Calculator Knowledge Article

View side-by-side comparisons of the following medical plan options:

POS Plans

HDHP vs. Blue PPO

HDHP, POS B, and POS D