Journal Entries

- RIT/

- Office of the Controller/

- Accounting & Reporting/

- Journal Entries

Training

Additional information about journal entries can be found here.

ITS Chargeback

The ITS Computer Services chargeback rates to be effective July 2025 (fiscal year 2026) are as follows:

- The rate for federal grant & contract funded faculty and staff is $248.90 per FTE/month

- The RIT rate for all other faculty and staff is $252.60 per FTE/month

- The rate for RIT students is $252.60 per FTE/month

For more information about the ITS Computer Systems and Network Charges, visit the ITS website.

Departmental Chargebacks

Introduction

Certain RIT departments provide goods or services to other departments. These are referred to as "non-standard" chargebacks (e.g. ITS, FMS Work Orders, Dining Services, Catering, and the HUB). Definition of "standard" monthly chargebacks below in Helpful Definitions.

Purpose

Departments incur expenses in order to provide goods and services. They must recover these costs in order to maintain budgetary control.

NOTE: This is not revenue to the departments. The total dollar amount of debits (expenses) produced by inter-department transactions must equal to the total dollar amount of credits (recovery) at the end of each fiscal year. Refer to the list of definitions below.

Persons Authorized to Process Chargeback Entries

The financial representative in the department providing the goods or services is authorized to process a chargeback journal entry. Although this chargeback may be initiated by department through an individual service area's order form, i.e. HUB or Dining Services, the receiving department is not authorized to process the chargeback entry. The receiving department should contact the service department directly if they have not been charged for the goods or services.

Billing Process

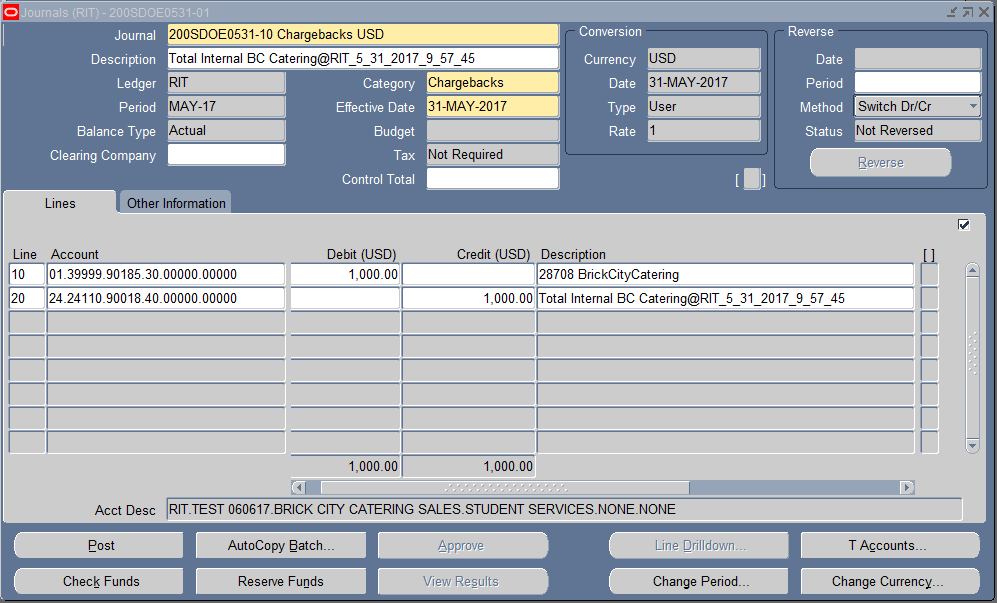

Departments who provide the goods and services are required to prepare and upload a manual journal entry in the month the transaction(s) occurred. The providing department is also responsible for maintaining the supporting documentation provide to other departments as needed. The entries should be structured as such:

- The entry category must be "Chargebacks".

- Debit (charge) the chargeback expense object code on the recipient department(s)' account

- Credit (recover) the chargeback object code on the providing department's own account

- Each line description must contain a billing reference number or code for the recipient departments' records.

- There are specific object codes. The recovery object code range is 90012-90065. The expense object code range is 90100-90981. (See example of a billing entry below). Refer to the Chart of Accounts on the Controller's website.

Difference between "Chargebacks" and "Adjustment" journal entries

Generally, a chargeback entry will be used when the primary function of a department is providing goods or services. In other cases, one department will make a purchase, for example supplies expense, which will be shared among several others. The appropriate journal entry for this would be an adjusting entry. The department would debit the receiving department(s') supplies expense object codes for a portion of the total supplies purchase and credit the supplies object code on the department who made the purchase. These are "Adjustment" journal entries.

Process for Billing Internal Charges to Departments/Projects

Example:

- In April 2017, a RIT employee in Dept# 39999 orders food from Brick City Catering Sales for a reception that will be held on May 15th, 2017. The total amount to be charged is $1,000. If the transaction occurred, then prior to the close of the MAY-17 period, Brick City Catering prepares a manual journal entry to charge Dept# 39999 so it can recover the costs that were incurred.

Using RIT Chart of Accounts to Select Proper Chargeback Object Code

Access the link to the chart of accounts via the Controller's website on Accounting and Financial Reporting page; Chart of Accounts - Accounting & Financial Reporting

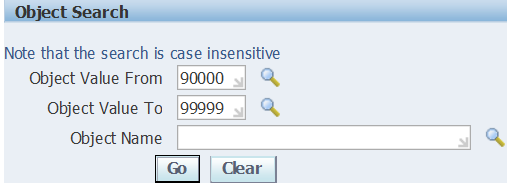

From the Chart of Accounts select the tab "RIT Object Search". You can search either by number and/or by name.

Search by number:

To view all chargeback object codes, enter 90000 in the "Object Value From" box and 99999 in to "Object Value To" box (see below) the select "Go".

Search by name:

If you know part of the object code's name you can enter the information in the "Object Name" field while using the % wildcard before and after the information then select "Go".

If you have any questions about this information, please contact one of the individuals listed below:

- Non-Standard Chargebacks:

Accounting Operations, email: acctg@rit.edu - Standard Monthly Chargebacks:

RIT Budget, email: budget@rit.edu

Helpful Definitions

-

Chargeback - an expense for goods or services charged to one RIT department (or project) by another RIT department.

-

Chargeback Credit - recovery for charges billed by an RIT department to another RIT department or project for goods and services.

-

Chart of Accounts - the account structure RIT uses to record transactions and maintain account balances.

-

Non-standard Chargeback - all miscellaneous chargebacks (internal charges) fall into this category. Examples of non-standard chargebacks include ITS and Telecommunications charges, FMS Work Orders, Dining Service Hospitality and Catering Sales, HUB, CET, Talent Development, and other miscellaneous internal charges.

-

Standard Monthly (SM) Chargeback - an internal charge processed each month by the Budget Office. Standard monthly chargebacks include expenses for utilities, FMS maintenance services, insurance, overheard, space rentals, Public Safety, etc.

-

Recovery - the amount a billing department receives when charging another RIT department for goods or services.