RIT Amazon Business Program

- RIT/

- Office of the Controller/

- Buying & Paying/

- RIT Amazon Business Program

Overview

The RIT Amazon Business Program streamlines purchasing for faculty and staff, providing access to business-exclusive pricing, enhanced analytics, and compliance with university purchasing policies. Designed for efficiency, the program ensures users can make smart purchasing decisions while staying within RIT guidelines.

Important Reminder to Participants

Participation in this program is required if you plan to purchase goods through Amazon Business using your RIT procurement card. Your Amazon Business account will be set up under one RIT email address, and you can link multiple RIT procurement cards to the same account.

Program Benefits

- Tax Exemption: This exception is already enabled in our RIT Amazon Business account, so you no longer need to request it.

- Policy Compliance: Ensure purchases align with university policies.

- Free Two-Day Shipping on qualifying orders consisting of Amazon Fulfilled Items over $25 Learn More

- Business Pricing and quantity discounts on selected items

- Tax Exempt Purchasing for qualified items

- Business-optimized search and browse functionality

- Enhanced reporting & reconciliation

- Dedicated Business Customer Service

Group Emails

Group emails can no longer be used for purchases through the RIT Amazon Business Account.

Starting April 1, 2025, we’re enabling Single Sign-On (SSO) for the RIT Amazon Business Account. Moving forward, purchases must be made by a designated university employee who can log in with SSO.

This change aligns with best practices used by other higher education institutions for the following reasons:

- Compliance with Procurement Policies: The University’s agreement with PNC requires that the procurement card be used only by designated university employees for official RIT business. SSO authentication will help enforce this requirement.

- Tax Exemption Integrity: The Amazon Business account is linked to RIT’s tax exemption, meaning all purchases must align with the University’s exempt purpose. Since we do not review individual purchases, we rely on the designated employee managing the account to ensure compliance. If any questions arise, that individual would serve as the point of contact to justify purchases. Maintaining our tax exemption is essential for protecting RIT and its status.

New User Access

New users can request access to the Amazon Business Program by submitting a ticket through the RSC.

After submitting and getting approval you will receive an email invitation from Business@Amazon.com to join the RIT Amazon Business Account. Follow the instructions below to accept the invitation.

How to Accept the Invitation and Set Up Your Account

Your RIT email address is used to activate a new Amazon Business account. Issues may occur in the registration process if your RIT email address is already linked to an existing Amazon.com account (for personal use). Before registering for an Amazon Business account, follow these steps to prevent any issues.

- Do you already have an Amazon.com account for personal use?

- NO - You have met these requirements and can skip to the Registration Instructions section.

- YES - Answer Question #2, below.

- Is your RIT email address linked to your Amazon.com account?

- NO - You have met these requirements and can skip to the Registration Instructions section.

- YES - You must unlink your RIT email address from your Amazon.com account (it can be replaced with your personal email address). Once your RIT email address is no longer linked to your existing Amazon.com account, you can follow the Registration Instructions.

- Request access to RIT Amazon Business by submitting this RSC ticket.

- Locate the email invitation from Business@Amazon.com

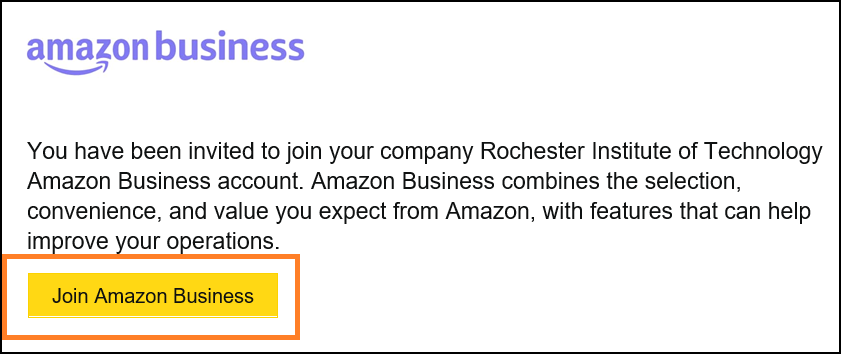

- Click the yellow Join Amazon Business button within the email (refer to the following image)

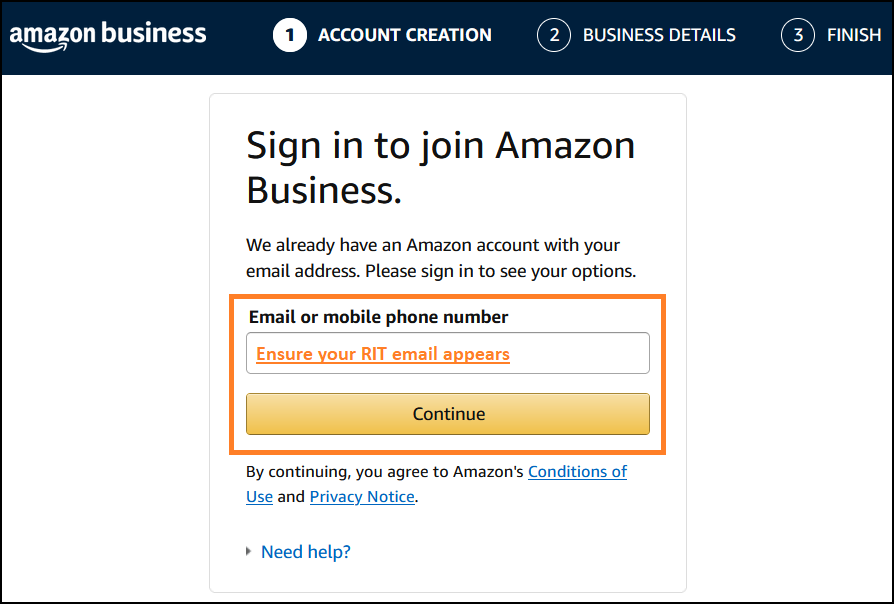

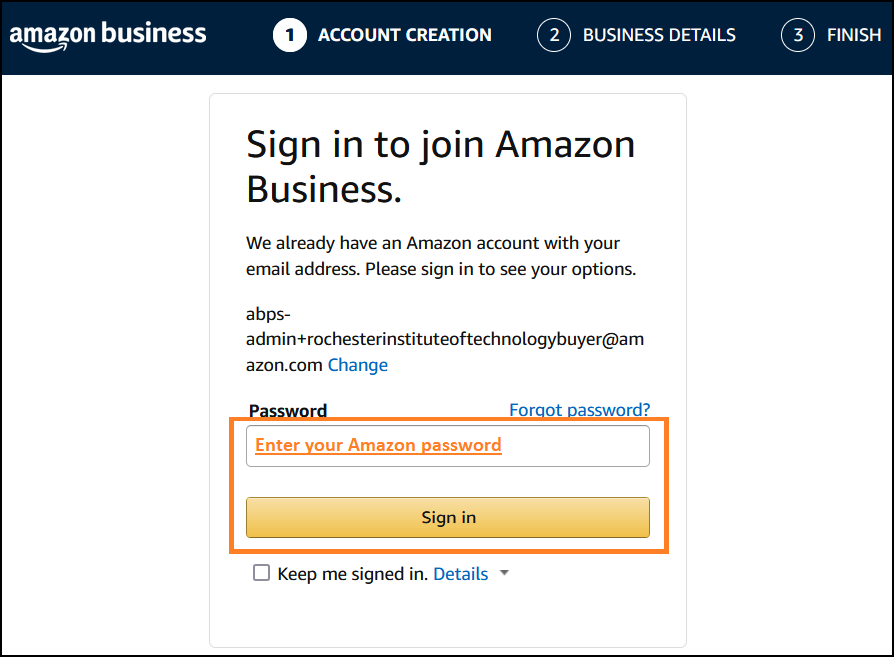

- You will then be prompted to sign in to your Amazon.com account associated with your RIT email

- Please ensure you know your password to this account. Otherwise, you will need to reset your password.

- Once you’ve successfully entered your credentials, select the best option based off your purchasing behaviors:

- If you have not made personal purchases (business only purchases)

- Click Rochester Institute of Technology business shopping only

- Click Next

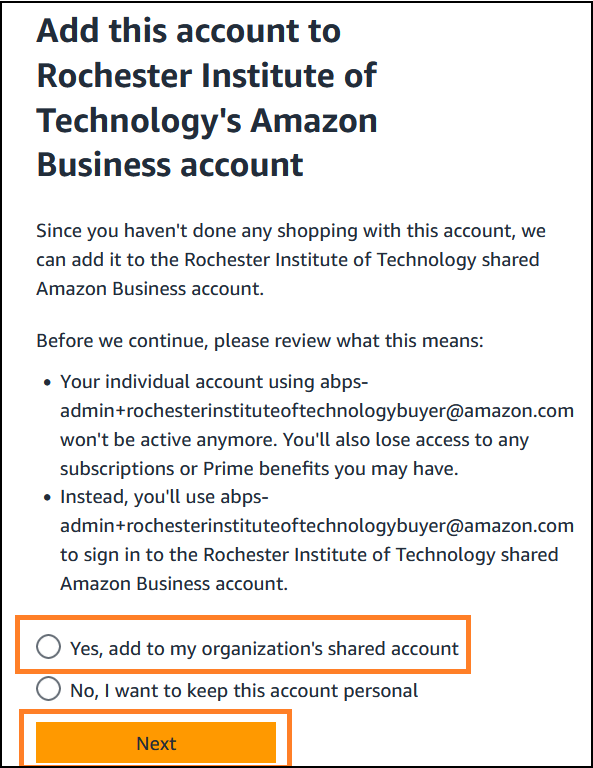

- Click Yes, add to my organization’s shared account

- Click Start using Amazon Business

- Proceed to Step #6

- If you have made personal purchases

- Select either:

- Personal shopping only, or

- A mix of Rochester Institute of Technology and personal shopping, or

- I’m not sure

- Next, you’ll be asked to split those personal purchases into a personal email

- Create a new Gmail, Yahoo, or Hotmail email address before proceeding with selecting the option above

- Once you’ve split any personal purchases into a personal email, you will be starting off blank with your RIT email within the RIT Amazon Business Account

- Click Start using Amazon Business

- Proceed to Step #6

- Select either:

- If you have not made personal purchases (business only purchases)

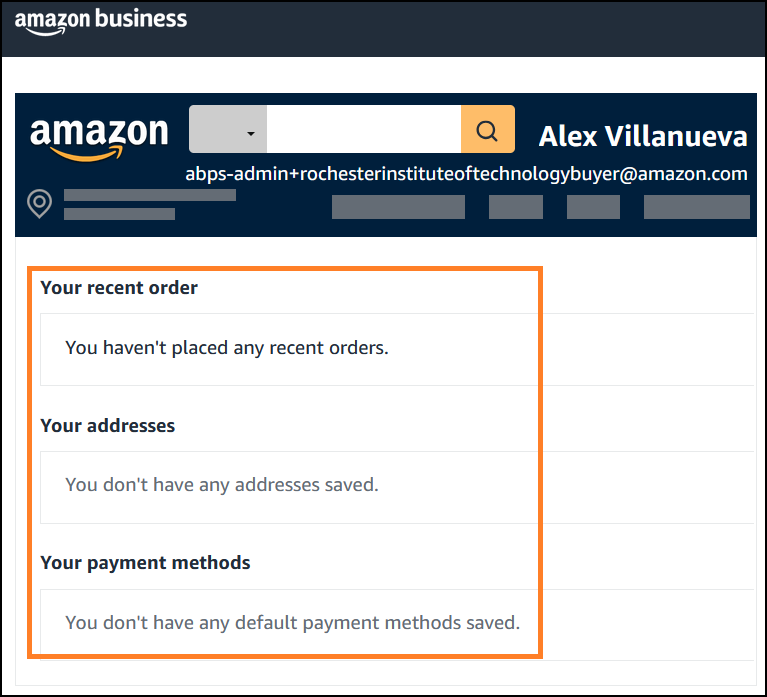

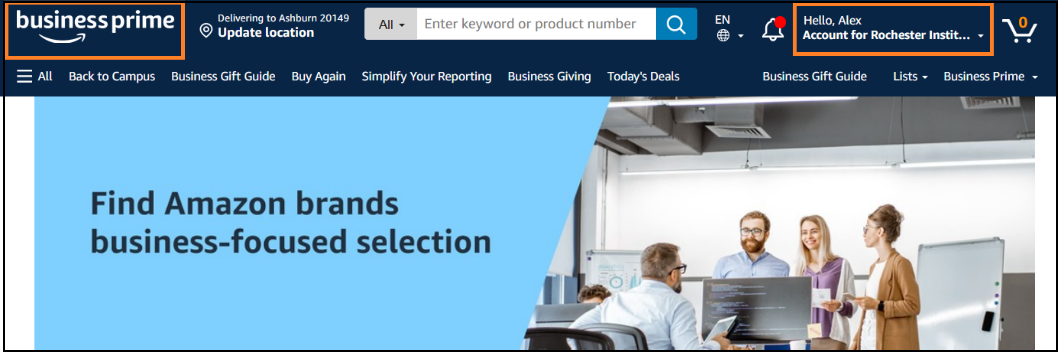

- Once you’ve completed your registration process within Amazon Business, please confirm your homepage view looks like the following:

- In the top-left corner of the screen, you should see the Business Prime logo

- In the top-right corner of the screen, it will read Hello, Your Name and Account for Rochester Institute of Technology

Contact & Support

Amazon Support

Phone: 844-428-3060

Schedule a Call

RIT-Specific Inquiries

Nicholas Varno

Email: ngvpur@rit.edu

FAQs

No. All RIT-related purchases must be made through the RIT Amazon Business account to ensure tax exemption and compliance.

No. Only an RIT P-Card may be used for purchases within the Amazon Business Program.

To get a purchasing group within RIT’s AB account, you need to ensure all individuals in the group are set up first. Then, request the creation of a group for your department by providing the list of names you want included to Nicholas Varno at ngvpur@rit.edu

If an item is not available through an RIT-preferred supplier, you may proceed with purchasing through Amazon Business. For additional questions or to request access, contact the Procurement Services Office at purchase@rit.edu.